What Is Tax Return Calculator?

A tax return calculator is a digital tool that helps individuals estimate their tax refund or the amount of tax they may owe. It provides a quick and easy way to get a general idea of your tax position, making financial planning and tax preparation much simpler.

Key Features and Benefits

- Instant Estimates: They provide a quick and immediate estimate of your tax refund or payable amount.

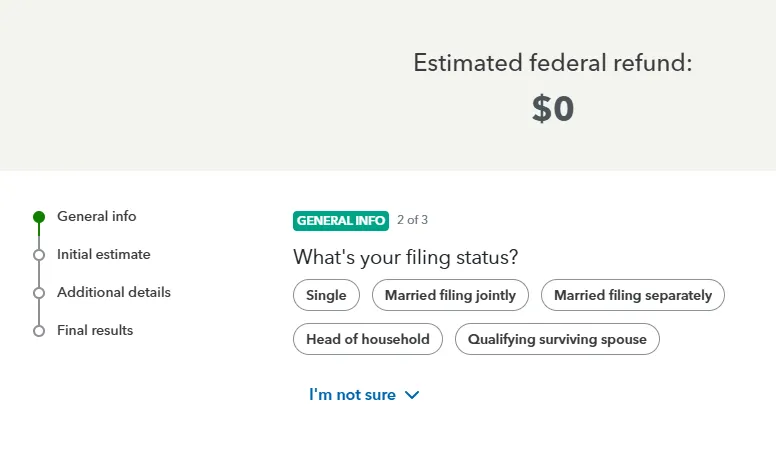

- User-Friendly Interface: Most calculators have a simple, step-by-step process that makes it easy for you to enter your financial details.

- Educational Tool: Using a calculator can help you understand how different factors like deductions and offsets impact your final tax position.

- Financial Planning: By giving you a preliminary estimate, a calculator can help you budget for a potential tax refund or prepare for a tax bill.

- Dynamic Calculations: Many advanced calculators update your estimate in real-time as you add or change details, allowing you to see how each entry affects your final result.

How Tax Return Calculator Works

A tax return calculator works by applying a series of logical steps and calculations to the financial information you provide, mirroring the process a human would follow when preparing a tax return.

The goal is to estimate your tax liability and compare it to the amount of tax you've already paid.

Step-by-Step Process

1. Gathering Your Information

First, the calculator asks you for key information that determines your tax situation. This includes:

- Filing Status: Are you single, married filing jointly, married filing separately, or head of household? This is a crucial factor that determines your tax brackets and standard deduction amount.

- Income: This is a comprehensive figure that includes all sources of income, such as wages from a job (found on your W-2), self-employment income, interest, and investment dividends.

- Tax Withheld: This is the amount of federal and state taxes that your employer has already taken out of your paychecks throughout the year.

2. Calculating Your Taxable Income

The core of the calculation is to determine your taxable income. The calculator does this by following these steps:

- Calculate Gross Income: The calculator sums up all your income sources to get a total gross income.

- Calculate Adjusted Gross Income (AGI): From your gross income, the calculator subtracts certain “above-the-line” deductions, also known as adjustments to income. These can include contributions to a traditional IRA, student loan interest, or certain educator expenses.

- Determine Your Deduction: The calculator then determines whether you should take the standard deduction or itemized deductions.

3. Calculating Your Tax Liability

- Once the calculator has your taxable income, it applies the relevant tax brackets. The U.S. has a progressive tax system, meaning different portions of your income are taxed at different rates. The calculator works through these brackets to determine your total tax bill.

- For example, if the first $10,000 of taxable income is taxed at 10% and the next bracket is 12%, the calculator would apply the 10% rate to the first $10,000 and the 12% rate to the income that falls into the second bracket. This process continues through all the applicable brackets.

4. Applying Credits and Final Calculation

After calculating your total tax bill, the calculator considers any tax credits you may be eligible for.

- Tax Credits: Unlike deductions, which reduce your taxable income, credits directly reduce your tax bill, dollar-for-dollar. Examples include the Child Tax Credit, education credits, or the Earned Income Tax Credit.

- Refundable vs. Nonrefundable Credits: The calculator distinguishes between these two types. Nonrefundable credits can reduce your tax liability to zero, but you won't get any leftover amount as a refund. Refundable credits can reduce your tax to below zero, potentially resulting in a refund even if you don't owe any tax.

5. Final Comparison

Finally, the calculator compares the total tax you owe (after applying credits) to the amount of tax you had withheld from your paychecks.

- Tax Refund: If the tax you had withheld is more than the tax you owe, the calculator estimates you will receive a tax refund.

- Tax Due: If the tax you had withheld is less than the tax you owe, the calculator estimates that you will have to pay the remaining amount to the government.

Why Tax Return Calculator Is Useful

In essence, a tax return calculator is a sophisticated tool that automates the complex series of steps and formulas used to determine a person's tax liability, providing a quick and easy-to-understand estimate of their tax outcome.

A tax return calculator is a useful and practical tool for various reasons, going beyond just getting a number.

1. Financial Planning and Budgeting

- Estimate your refund or tax due: This is the most common use. Knowing whether you're likely to get a refund or owe the government money helps you plan your finances. You can budget to pay a potential tax bill or decide how to use a refund.

- Adjust your withholding: Many tax calculators also act as withholding estimators. This helps you determine the correct amount of tax to have withheld from your paycheck (via your W-4 form). You can adjust your withholding to get a larger refund or to have more money in each paycheck throughout the year, which can be useful for managing cash flow.

- Evaluate the impact of financial decisions: The calculator can show you how certain life events and financial choices will affect your taxes. You can see the tax implications of getting married, having a child, buying a home, or making contributions to a retirement account like a 401(k) or IRA.

2. Understanding Your Taxes

- Educational value: By entering different amounts for income, deductions, and credits, you can see firsthand how each factor impacts your final tax bill. This helps you understand your own tax situation better.

- Compare tax regimes: Some calculators allow you to compare filing under different tax structures, such as the old versus new tax laws, to see which option is more beneficial for you.

- Identify tax-saving opportunities: By showing you the effect of deductions and credits, the calculator can highlight areas where you could potentially save money. For example, it might prompt you to consider making additional charitable contributions or contributing to an IRA.

3. Convenience and Accuracy

- Quick and easy estimates: Tax calculators provide a fast and convenient way to get an estimate without having to manually sift through complex tax forms and instructions.

- Error reduction: They are designed to follow current tax laws and perform calculations without human error, providing a more reliable estimate than manual calculations.

- Pre-filing preparation: Using a calculator can help you gather and organize the necessary financial documents, such as W-2s and 1099s, before you're ready to file your official tax return. This makes the actual filing process smoother and quicker.

Important Considerations

It is crucial to remember that a tax return calculator provides an estimate only. The final, official calculation is determined by the relevant tax authority when you lodge your actual tax return.

The accuracy of the calculator's result is entirely dependent on the information you provide. Using a reputable and up-to-date calculator that is aligned with the current tax laws is essential for getting the most reliable estimate.

Explore More Free Calculators

One Rep Max Calculator

Calculate your maximum strength for weightlifting and strength training.

Try Calculator